Blog > May 2024 Newsletter - Changes to Know Affecting the BC Real Estate Market

May 2024 Newsletter - Changes to Know Affecting the BC Real Estate Market

by

I hope you’re doing well this May! In this month’s newsletter, I’m sharing some noteworthy real estate policy updates, the latest Island Living Today expert talks, and local island events. Happy reading!

Housing affordability is the hot topic across the country, but especially in British Columbia where residents pay the most for buying and renting compared to other Canadians. In response, the BC government has made multiple policy changes impacting the local real estate market. Here are some important ones to note.

Newly Built Home Exemption

The Newly Built Home Exemption reduces or eliminates the property transfer tax on qualifying purchases of a principal residence. Recent adjustments aim to provide relief for home buyers purchasing newly constructed properties.

Starting April 1, 2024, the fair market value threshold for a full exemption for newly built homes is increased from $750,000 to $1,100,000. Additionally, a partial exemption will be available for properties valued just above this threshold. The phase-out range extends to $50,000 above the threshold, meaning properties with a fair market value exceeding $1,150,000 will not qualify for the Newly Built Home Exemption.

BC Home Flipping Tax

Starting January 1, 2025, the proposed BC Home Flipping Tax will be applicable to any residential property sold within two years of its purchase. The tax rate will vary based on the duration of ownership. Sellers who sell within the first 365 days will face a 20% tax rate on the income earned from the sale, gradually decreasing until it reaches zero percent at the 730-day mark.

Additionally, exemptions will be granted for various circumstances, including separation or divorce, death, disability or illness, relocation for work, involuntary job loss, change in household membership, personal safety concerns, and insolvency. Further exemptions may be announced at a later date. These exemptions aim to provide relief for individuals facing unforeseen circumstances or life changes, ensuring fairness in the implementation of the home flipping tax.

The tax will apply to both properties and assignments of contracts and is in addition to any existing federal or provincial income taxes incurred from the sale of the property, including the federal anti-flipping tax.

BC's Short-Term Rental Accommodations Act

On May 1, 2024, BC enacted the Short-Term Rental Accommodations Act with the goal of returning more short-term rental units to the long-term housing market. This legislation limits short-term rentals to the host’s primary dwelling along with one secondary suite or accessory dwelling unit. This regulation will be applicable to communities with a population exceeding 10,000 individuals, as well as smaller adjacent communities. However, specific exemptions will be granted to certain property types, including timeshare properties, hotels, motels, lodges, student accommodations, and strata guest suites. Additionally, exemptions will be extended to particular regions such as agricultural land, ski and resort areas, and Trust areas under the Islands Trust Act.

As outlined in the Act:

- A principal residence denotes the primary dwelling where an individual resides for a majority of the calendar year.

- A secondary suite is a self-contained living unit within a larger dwelling, featuring independent kitchen, sleeping, and bathroom facilities.

- An accessory dwelling unit is a standalone living space, complete with its own kitchen, sleeping area, and bathroom facilities, situated on the same property as the principal residence (e.g., a laneway home or garden suite).

Local governments retain the authority to enact more stringent bylaws in addition to the baseline standards established by the province, thereby ensuring flexibility in addressing unique community needs.

First-Time Home Buyers’ Program

The First-Time Home Buyers' Program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home. Effective April 1, 2024, first-time home buyers can take advantage of the exemption if the fair market value of the purchase is $835,000 or less. This a welcomed increase from the previous limit of $500,000.

For purchases up to $500,000, first-time home buyers are exempt from any property transfer tax. For purchases up to $835,000, property transfer tax is only payable on the difference above $500,000 at a rate of 2%. Partial exemption is available for purchase prices between $835,000 - $860,000. Anything above a $860,000 purchase price, the tax must be paid in full. Property transfer tax is paid upfront and cannot be wrapped into the mortgage.

If you’re planning to buy or sell, and want to know how these government programs affect you, get in touch and let’s chat more!

Join the Conversation on June 5

Do you know a “good weed” from a “bad weed?” Join me at the next Island Living Today talk to meet Hunter Jarratt, aka the “Invasive Species Guy.” With over 40,000 social media followers, he’s an environmental educator who’s passionate about protecting the beauty of Vancouver Island and BC. He’ll teach us how to identify and manage invasive species on our properties, and how we can cultivate more biodiverse and drought-friendly gardens in the process.

Cultivate Your Dream Garden by Managing Invasive Species

Time: Wednesday, June 5, 2024 (6-7 PM Pacific Time)

Save your Seat using this link.

Pest Control for Your Home

At last month’s Island Living Today talk, Patrick Preston (Accredited Home Inspector at HouseMaster) and Bryan Dumesnil (Operator at VI Pest Control) shared ways to prevent, detect, and vanquish common household pests to protect you and your home’s health.

We discussed:

- Common household pests ranging from ants and termites to bedbugs and mice

- Ways to prevent pest problems such as reducing clutter, regularly inspecting your home’s surroundings, and sealing potential entry points

- Do-it-yourself versus professional pest management options

It was eye-opening to hear what critters can enter a Vancouver Island home! Watch the full recording to learn proactive pest management strategies.

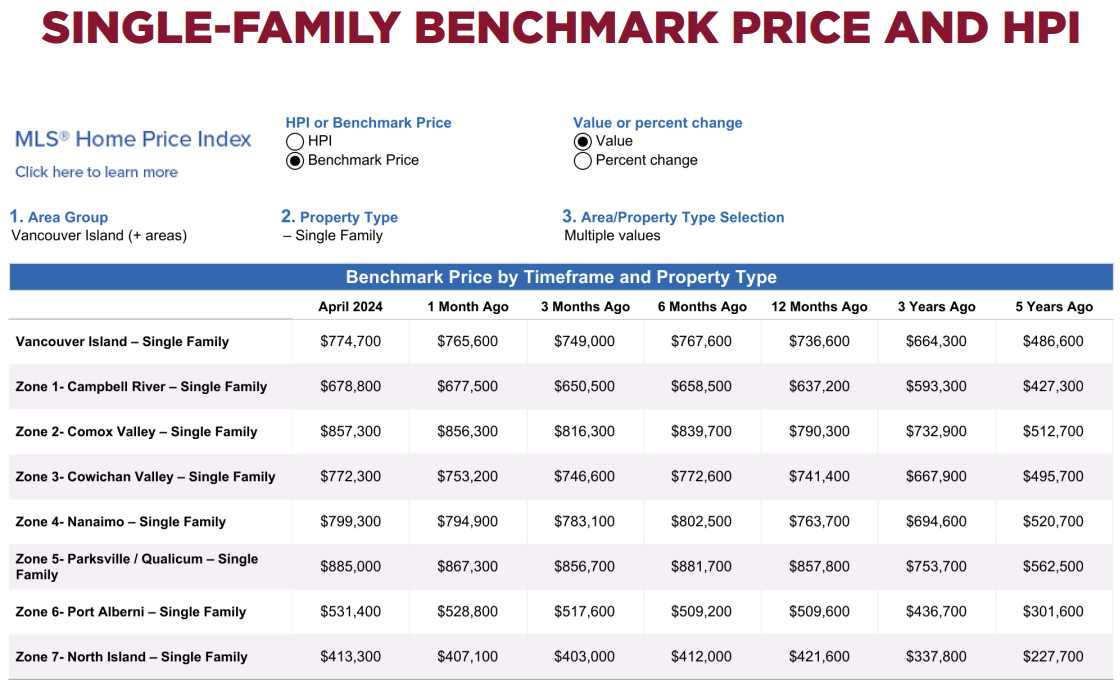

Higher Inventory and Creeping Prices

April 2024 kicked off the active real estate season with 1,271 active listings of single-family homes on Vancouver Island, an increase from the 956 postings one year ago. Last month’s inventory of 381 condo apartments and 368 row/townhouses are also up from last spring. Meanwhile, the benchmark price of a single-family home on Vancouver Island creeped up to $774,700 from $765,600 in March 2024. While greater inventory is good news for buyers, sellers are also adjusting their selling prices. It’s been a busy month of showings, so reach out if you’d like help navigating your options!

Community Events to Explore

Oceanside Classical Concerts Society Emerging Artist & Scholarship Winner Concert

June 15 | 7:00pm

Knox United Church (345 Pym Street, Parksville)

Vancouver Island violinist Jeremy Potts will perform with Jany Lu, pianist and faculty member of the Victoria Conservatory of Music. Also appearing will be past winners of the Oceanside Classical Concerts annual music scholarship. Cost: $30, $15 for students

Downtown Parksville Summer Events

Memorial Plaza, select dates from June to August

- Picnic in the Plaza - Tuesdays from 6-8:30pm

- Hot Jams, Cool Games - Wednesdays from 3-6pm

- Summer Singalong - Thursdays from 6:30-8pm

3521 Dolphin Dr, Nanoose Bay

- Live Music Wednesdays from 6pm to closing

- Thursday Night Events from 6pm until late